Managing finances and maintaining a stress-free lifestyle can seem like an arduous task. Yet, with the right strategies and mindset, it’s entirely possible to cultivate a financially sustainable and mentally serene life. This guide provides practical tips and insights on saving money effectively while minimizing stress. Through intelligent budgeting, investing, and mindful living, you can unlock a more balanced and fulfilling life. Join us as we explore actionable steps to achieve financial stability and peace of mind, paving the way toward a brighter, more secure future.

Understand Your Financial Picture

Before you can start saving money and reducing stress, you must clearly understand your current financial situation. This involves tracking your income, expenses, debts, and savings. By having a comprehensive overview, you can identify areas where you spend unnecessarily and opportunities to save more effectively.

Creating a budget is the next step in this process. A well-thought-out budget serves as a roadmap for your finances, helping you to prioritize your spending, cut down on unnecessary expenditures, and allocate funds toward your savings goals. This clarity alone can significantly reduce financial stress and give you a sense of control over your money. There are websites where you can see coupon deals that can help you save money on groceries and other essential items. Consider using budgeting apps or spreadsheets to track your spending and stay within your financial limits.

Set Realistic Financial Goals

Goals guide financial decisions and help you maintain focus on the bigger picture. Whether you’re saving for a dream vacation, building an emergency fund, or paying off debt, setting realistic financial goals is crucial. To increase your chances of success, make sure your goals are specific, measurable, achievable, relevant, and time-bound (SMART).

Once your goals are in place, break them down into smaller, more manageable steps. If your objective is to save $10,000 in a year, figure out how much you need to save each month and then each week. Making consistent, incremental progress will motivate you and make larger goals seem less daunting.

Automate Your Savings

Automating the process is one of the most effective ways to save money. Set up automatic transfers from your checking account to a savings account every payday. This “set it and forget it” approach ensures that you save regularly without thinking about it, making it easier to stick to your savings goals.

In addition to regular savings, consider automating your bill payments to avoid late fees and unnecessary stress. This helps you manage your finances more efficiently and maintains a good credit score, which can be beneficial for future financial endeavors.

Cut Unnecessary Expenses

Identifying and eliminating unnecessary expenses is critical to boosting your savings. Start by reviewing your recurring monthly costs and pinpoint areas where you can cut back. Subscription services, dining out, and impulse purchases are common areas where many can find savings without significantly impacting their lifestyle.

Remember, cutting expenses does not mean depriving yourself of all leisure activities. It’s about making smarter choices and finding cost-effective alternatives. For example, instead of a dinner date at an expensive restaurant, opt for a romantic homemade meal or explore free or low-cost entertainment options in your community.

Invest in Your Financial Education

The more you know about personal finance, the better equipped you’ll be to make informed decisions about your money. Investing time in your financial education can dramatically reduce stress levels by increasing your confidence in handling finances. Many resources are available, from books and blogs to podcasts and online courses covering various topics, including budgeting, investing, and debt management.

Understanding the basics of investing can also open up new avenues for growing your savings. While investing carries risks, being well-informed can help you make choices that align with your risk tolerance and financial goals, potentially leading to significant long-term benefits.

Balancing mindful spending and strategic saving is the key to saving money and minimizing stress. Understanding your financial situation, setting realistic goals, automating savings, cutting unnecessary expenses, and investing in your financial education can pave the way toward a more financially stable and mentally serene future. Remember that it takes time and patience to see results, but with persistence and determination, you can achieve your financial goals and create a more secure and fulfilling life. With the right tools and mindset, you can take control of your finances and reduce stress one step at a time. Keep learning, stay focused, and watch as your hard work pays off through financial stability and peace of mind.

Recognizing the Need for Support: When Financial Stress Becomes Overwhelming

Managing your finances and mental health is a journey of ups and downs. While the strategies outlined above can significantly aid in creating a balanced life, it’s crucial to recognize when you might need additional support. Understanding when to seek therapy, considering medication, setting clear treatment goals, and monitoring progress is vital in navigating the more challenging times.

Managing your finances and mental health is a journey of ups and downs. While the strategies outlined above can significantly aid in creating a balanced life, it’s crucial to recognize when you might need additional support. Understanding when to seek therapy, considering medication, setting clear treatment goals, and monitoring progress is vital in navigating the more challenging times.

Identifying the Signs

Financial stress can manifest in various ways, impacting your bank account and overall well-being. Here are a few signs that it might be time to seek professional help:

- Persistent Anxiety or Depression: If financial worries are causing you constant anxiety or depression, and these feelings persist despite your efforts to manage them, professional help can offer relief.

- Impact on Daily Functioning: Financial stress affects your ability to perform daily tasks, maintain relationships, or fulfill work obligations, it signals that the issue requires attention.

- Physical Health Decline: Stress, especially financial stress, can lead to physical health problems like headaches, sleep disturbances, or changes in appetite. If you notice these, consider them a nudge to seek help.

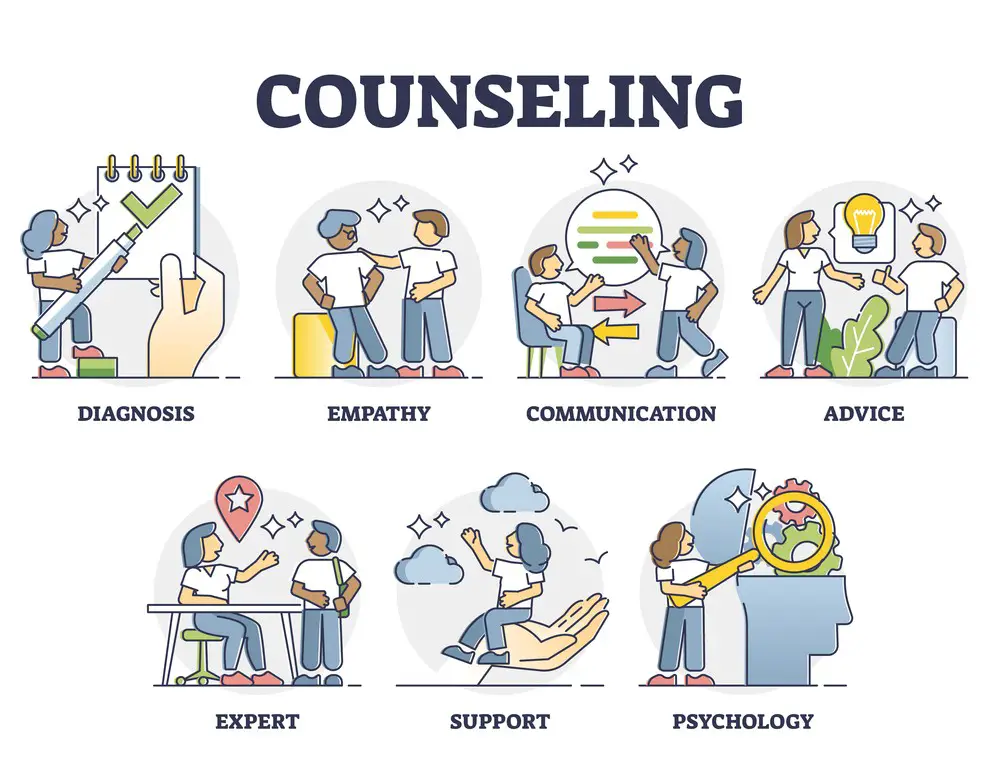

Seeking Therapy vs. Medication

- Therapy: Ideal for those who need to talk through their issues, develop coping strategies, and understand the root causes of their financial stress. Therapy can provide tools and techniques to manage stress effectively, without needing medication.

- Medication: Sometimes, stress and its associated mental health issues can be severe enough to require medication. This is particularly the case when the stress is causing significant impairment or is due to, or resulting in, a chemical imbalance in the brain. Medication should always be considered and managed by a medical professional.

Setting Goals for Treatment

The aim of seeking professional help is not just to alleviate the symptoms but to foster a healthier relationship with finances and stress. Goals for treatment should include:

- Improved Coping Strategies: Learning how to handle financial stress in healthy ways.

- Enhanced Understanding and Skills: Gaining insights into managing finances and making informed decisions.

- Emotional Resilience: Building strength to face financial challenges without significant distress.

Monitoring Progress

Keeping track of your progress is crucial. This could mean noting improvements in your mental health, changes in your financial situation, or both. Regular check-ins with a therapist or counselor can help adjust strategies as needed to ensure continued progress.

Alternative Paths to Wellness

For those who may find traditional therapy or medication isn’t the right fit or who are looking for additional support avenues, here are a few alternatives:

- Financial Counseling: Specifically focuses on improving your financial situation and providing education on money management.

- Support Groups: Connecting with others facing similar challenges can offer insights and emotional support.

- Mindfulness and Meditation: Practices that can help manage stress and anxiety related to finances or otherwise.

Recognizing when you need help and taking the step to seek it out is a sign of strength. Addressing the root causes of financial stress, whether through therapy, medication, or other forms of support, can lead to a healthier and more fulfilling life. Remember, asking for help is okay; doing so can be the first step towards regaining control and moving towards a brighter future.

- How to Save Money & Minimize Your Stress Levels: A Full Guide - March 10, 2024

- How to Minimize Stress During Your Injury Recovery Journey - March 9, 2024

- Enhancing Rest with Organic Vapes - March 6, 2024

This site contains affiliate links to products. We will receive a commission for purchases made through these links.