Financial abuse may not be as apparent as other forms of abuse, but it is just as damaging and debilitating for those who experience it. Narcissist financial abuse occurs when a narcissist manipulates and controls their partner’s financial resources to maintain power and control within the relationship. This insidious form of abuse can have long-lasting effects on victims, often leaving them financially and emotionally drained.

Understanding the nature and implications of narcissistic financial abuse is essential for protecting oneself and others from its harmful effects. By recognizing the signs of financial abuse and learning how to prevent it in a relationship, individuals can take the steps necessary to safeguard their own financial well-being and emotional health.

Key Takeaways

- Narcissist financial abuse refers to the manipulation and control of a partner’s financial resources.

- Recognizing the signs of financial abuse is critical for protecting oneself and others from its effects.

- Prevention strategies and resources are essential to overcoming and surviving financial abuse.

Understanding Narcissist Financial Abuse

Understanding Narcissist Financial Abuse

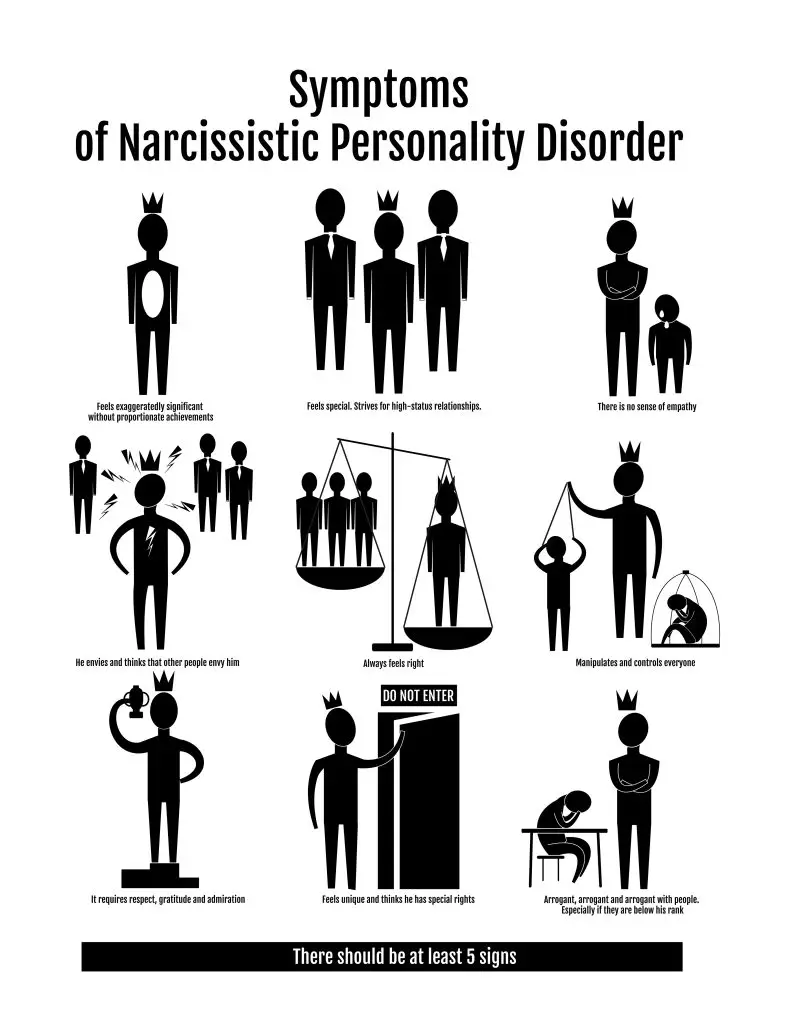

Narcissistic financial abuse is a form of control and manipulation that narcissists use to maintain power over their victims. This type of abuse can be subtle, making it challenging to recognize at first. However, knowing the warning signs may help you better understand and protect yourself from such situations.

Recognizing the signs: Narcissists often use money as a tool to control and manipulate their partners or family members. They may withhold funds, overspend, or even steal money from joint accounts, leaving their victims stressed, anxious, and financially unstable. In some cases, narcissists may also use lying and deceit to maintain control, including hiding assets or debts.

Impact on relationships: When a narcissist exploits someone financially, it erodes trust and security in the relationship. Victims may feel trapped, as if they have no choice but to stay in the manipulative relationship, either due to financial dependency or fear of reprisal. This can lead to long-term emotional and psychological damage for the victim.

Breaking free: If you suspect a narcissist is financially abusing you, it’s essential to take action. Begin by documenting instances of abuse, ensuring you have evidence of the manipulative behavior. Contact friends, family, or professionals for emotional support and guidance. Sometimes, it might be best to separate your finances, such as opening individual bank accounts or talking to a financial advisor.

Remember, defending yourself against narcissistic financial abuse is crucial for your emotional well-being and financial security.

Traits of a Financially Abusive Narcissist

Traits of a Financially Abusive Narcissist

Control and Power Dynamics

A financially abusive narcissist often seeks control and power in relationships. They may influence your financial decisions, pushing you to rely on them for money or forcing you to give up your financial independence. They could limit your access to funds, make all the major financial decisions, and conceal crucial information about joint finances.

- Joint accounts control: They may control joint bank accounts, ensuring you have no access or limited access to the funds.

- Belittling your financial contributions: A narcissist may downplay your income or devalue the work you do, making you feel inadequate or dependent on them.

- Forcing financial dependency: They may force you to quit your job or prevent you from working, making you dependent on their financial support.

Manipulation and Deception

Manipulation and deception are central to the behavior of a financially abusive narcissist. They may use lies and cover-ups to control the relationship’s finances and keep you in the dark.

- Lying about finances: A financially abusive narcissist might lie about their income, debts, or assets to keep you dependent and in a position of inferiority.

- Deceptive spending habits: They may waste money or hide significant purchases from you yet expect you to be responsible for financial stability.

- Financial infidelity: They may engage in secretive behaviors like opening credit accounts in your name, racking up debt without your knowledge, or hiding assets leading up to a divorce or separation.

Remember, it’s essential to recognize these traits and behaviors in your relationship. If you feel that you’re experiencing financial abuse at the hands of a narcissist, seek help from a professional or confide in someone you trust. By acknowledging the situation, you can take the necessary steps to regain control of your finances and life.

Effects of Financial Abuse on Victims

Physical Impacts

Financial abuse may lead to physical consequences as victims might feel stress and pain. High stress levels can cause various health problems, such as:

- Sleep disturbances

- Headaches

- High blood pressure

- Digestive issues

It’s essential to acknowledge your physical symptoms and seek medical advice to manage them effectively.

Psychological Impacts

Financial abuse has a significant effect on victims’ mental health and self-esteem. Some psychological consequences are:

- Fear: The uncertainty of your financial future can instill fear and anxiety. Worrying about meeting your basic needs is a constant concern.

- Lowered self-esteem: Abusers often manipulate and control their victims, chipping away at their confidence. This can lead to feelings of worthlessness and low self-esteem.

- Mental health issues: The ongoing stress from financial abuse can contribute to mental health problems like depression, anxiety, and even suicidal thoughts.

Remember that seeking help from mental health professionals and support groups can be crucial in coping with the psychological impacts of financial abuse. You are not alone, and resources are available to help you regain your footing.

Common Tactics of Financial Abuse

Common Tactics of Financial Abuse

When dealing with narcissistic financial abuse, it’s crucial to recognize the common tactics that abusers use to maintain power over their victims. Let’s explore some of these methods.

One prevalent tactic is controlling the finances by manipulating the household bills. You may find that your partner always insists on managing the bills, leaving you in the dark about the actual amounts and due dates. This ensures that you remain dependent on them for financial information, making it more difficult to regain control over your financial situation.

Abusers might also resort to threats and intimidation. This could involve threatening to cause harm if you don’t obey their financial demands or trying to make you feel guilty for not contributing enough financially. These threats can make you feel trapped and powerless, which is exactly what the abuser wants.

Another standard method narcissists use is stealing money or making unauthorized withdrawals from joint bank accounts. They may feel entitled to your funds and take advantage of your trust by secretly accessing your accounts without your permission.

Keep an eye out for these tactics:

- Gaslighting: A narcissistic abuser often uses gaslighting to make you question your reality, memory, or perceptions. They may claim that you have spent the money when in fact, they were responsible for the missing funds.

- Sabotaging employment opportunities: The abuser may actively try to hinder your ability to secure or maintain a job as a way to keep you financially reliant upon them.

- Withholding financial information: Sometimes, your partner may purposely keep you in the dark about your joint financial situation, such as investments, debt, or income.

To combat these methods, consider the following strategies:

- Educate yourself on your family’s finances, such as bills, income, and investments.

- Set up budgeting and saving plans to gain a sense of control over your financial future.

- Seek support from friends, family, or professionals for dealing with the emotional impact of financial abuse.

In summary, understanding the standard tactics of financial abuse can help you recognize when a narcissistic partner is manipulating you. Knowledge is power, and with this awareness, you can take steps to protect yourself and regain control over your financial well-being.

Recognizing Financial Abuse in a Relationship

It’s essential to spot the signs of financial abuse in a relationship, as it often goes hand-in-hand with narcissistic abuse. If you’re unsure whether you’re experiencing financial mistreatment, here are some warning signs to look out for:

- Controlling finances: Your partner dictates how you spend money, making it difficult for you to access it or decide when to spend it.

- Sudden changes in financial responsibility: You might suddenly be responsible for all the bills or other financial obligations.

- Withholding money: Your partner may refuse to give you money for essentials, like groceries or healthcare expenses.

- Demanding explanations: You must provide detailed accounts of your spending, even for small amounts.

Here are a few tips to help you respond to financial abuse in a relationship:

- Set boundaries: Establish your financial independence by opening a separate bank account (if you don’t have one) and limiting joint spending decisions.

- Seek professional help: Contact a financial advisor, therapist, or support group to help you navigate your situation.

- Document evidence: Keep track of incidents and conversations related to financial abuse.

- Develop a safety plan: Plan for your financial and emotional well-being if you need to leave the relationship.

Remember, financial abuse can take a toll on your mental and emotional health. It’s essential to protect yourself and seek help if necessary. Trust your instincts and stay assertive in maintaining control over your finances.

It’s never easy to confront financial abuse and neglect, but knowing the signs and having a plan can make the process smoother. Keep these tips in mind as you assess your situation, and don’t be afraid to reach out for support if needed. You deserve a healthy and balanced relationship, free from abuse.

Surviving and Overcoming Financial Abuse

Surviving and Overcoming Financial Abuse

When you’re a victim of narcissistic financial abuse, it can seem daunting to regain control of your life. But by setting boundaries, implementing coping mechanisms, and rebuilding your confidence, you can overcome these challenges. Let’s explore each aspect step by step.

Setting Boundaries

Setting boundaries is crucial in protecting yourself from further financial abuse. Here are some tips to help you establish your guiding principles:

- Decide on your non-negotiables: Determine your financial limits and stick to them. Resist any attempts by the abuser to coerce you into making decisions you’re not comfortable with.

- Create a personal budget: Establish clear budget lines for your finances and maintain consistency. A well-planned budget can help prevent financial manipulation.

- Communicate your needs: Have open and honest conversations about your financial expectations and how they align with your boundaries.

Coping Mechanisms

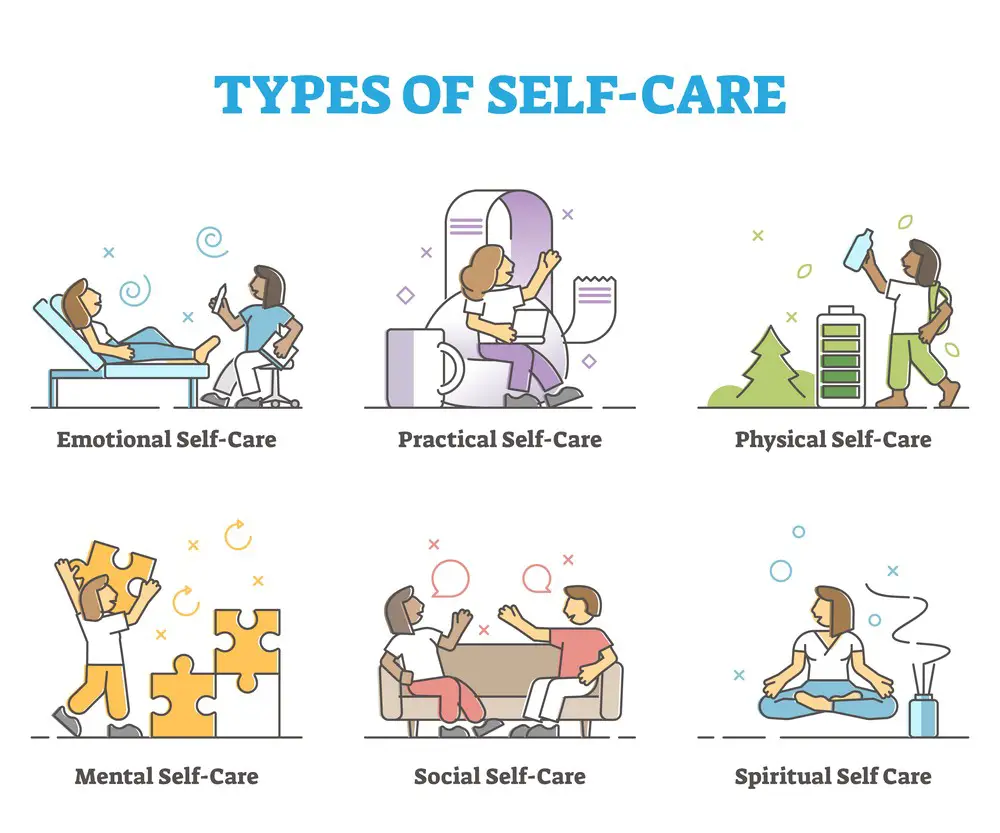

Financial abuse can leave you feeling helpless and overwhelmed. To regain your sense of control and well-being, consider implementing these coping mechanisms:

- Reach out for support: Surround yourself with friends, family, or support groups. Don’t hesitate to share your struggles and seek advice.

- Take time for self-care: Engage in activities that bring you joy and help manage stress, such as exercise, meditation, or hobbies.

- Learn about your rights: Educate yourself on your financial rights and available resources. This knowledge will empower you and make it easier to enforce your boundaries.

Throughout this process, remember that you are not alone. Many people have experienced financial abuse and emerged victorious. Building your confidence is vital to overcoming the harmful effects of abuse and finding stability in your life. As you establish your boundaries and practice coping mechanisms, be patient with yourself and stay firm in your resolve. The journey may be challenging, but the gains will be immeasurable – earning your freedom and taking control of your financial future.

Preventing Financial Abuse

Preventing Financial Abuse

One key aspect of protecting yourself from financial abuse is communication. Make it a point to foster open and honest conversations with your partner about money matters. Discuss your individual financial goals and your joint financial plans, and address any concerns or disputes that arise. Remember, a healthy relationship thrives on transparency and trust.

Establishing boundaries is another essential step in preventing financial exploitation. Work with your partner to lay out clear rules for financial responsibilities and decisions. This might include setting a threshold for joint purchases or creating a routine for household budget review.

Strive for fairness in your relationship’s financial landscape. While it’s normal for one partner to take on a more significant financial role, both parties should have access and control over shared finances. Equitable financial responsibilities ensure that neither person feels taken advantage of or pressured into making decisions they’re not comfortable with.

Before seeking external approval for large purchases or commitments, always consult your partner. This not only keeps the communication lines open but also strengthens your trust in each other. By involving them in major financial decisions, you create a sense of unity and awareness that helps guard against potential abuse.

Here are some practical tips to prevent financial abuse:

- Maintain separate bank accounts in addition to any shared accounts

- Regularly monitor your credit report for suspicious activity

- Save and invest money independently, as well as jointly

- Educate yourself about various financial matters, such as investments, tax planning, and debt management

- Build a strong support network of family and friends

In summary, prevention starts with acknowledging the risks of financial abuse and taking proactive steps to safeguard your finances. By fostering open communication, establishing firm boundaries, striving for fairness, and actively involving your partner in financial decisions, you’ll create a strong foundation that fosters trust, respect, and independence in your relationship.

The Red Flags in Your Wallet: When to Seek Therapy

The Red Flags in Your Wallet: When to Seek Therapy

Financial abuse can leave wounds deeper than any bank statement might show. Here are signs you might need professional support:

- Emotional Debt: Persistent anxiety or stress over finances, despite reasonable stability, could indicate underlying psychological impacts from financial abuse.

- Isolation Transactions: If you find yourself increasingly isolated due to financial constraints imposed by your partner, it’s a red flag that needs addressing in therapy.

- The Cost of Silence: When the fear of discussing money with your partner is overwhelming, it’s essential to seek therapy to find your voice again.

Breaking Free: Knowing When It’s Time to Walk Away

Recognizing when to step away from a relationship is tough, mainly when finances are used as chains.

- Bankruptcy of Trust: If financial secrets and lies become common, it’s a severe breach that sometimes can’t be repaired.

- Recurring Debt Cycles: A pattern of unexplained debts or financial crises that put you at risk can signify that it’s time to protect yourself by stepping back.

- Foreclosure of Happiness: When your overall well-being is constantly undermined by financial stress, consider that leaving may be the healthiest option.

Negotiating Your Financial Freedom: Signs It Can Be Managed

Not all financial abuse spells the end. Sometimes, there’s a chance for change.

- Willingness to Change: Look for genuine accountability and a readiness to seek help as a beacon of hope for managing the situation.

- Creating a Joint Budget: A transparent budget, respected by both partners, can be a foundation for rebuilding trust.

- Respecting Boundaries: Consistently respected financial boundaries promise a healthier financial dynamic.

Setting Goals for Growth: Establishing a New Financial Future

Setting Goals for Growth: Establishing a New Financial Future

Empowerment after abuse starts with setting and achieving financial goals.

- Short-Term Savings: Begin with small, achievable savings goals to rebuild a sense of control and security.

- Long-Term Planning: Engage in long-term financial planning for retirement and emergencies to regain independence.

- Educational Investments: Invest time in financial literacy classes or resources to protect and empower your future self.

Frequently Asked Questions

How do narcissists financially abuse their partners?

Narcissists may financially abuse their partners through various strategies. For example, they may control access to financial resources, restrict employment opportunities, and run up debt in their partner’s name. They might insist on having complete control over joint bank accounts or demand access to their partner’s personal financial information. The key takeaway is to recognize these patterns of control and manipulation and seek support to escape the abusive situation.

What are common signs of financial abuse by a narcissist?

Common signs of financial abuse by a narcissist include:

- Constant monitoring of your spending

- Restricting your access to money or financial accounts

- Sabotaging your efforts to gain financial independence

- Using your credit cards or personal information without permission

- Blaming you for their financial mismanagement

Remember that these patterns may be subtle or escalate over time, so be vigilant in recognizing these red flags.

How do narcissistic parents use money to control their children?

Narcissistic parents can use money as a tool to control their children by withholding financial support, manipulating them with promises of future inheritance, or creating a debt dependency. They may also outright threaten to cut off financial support if their children do not agree to their demands. Recognizing these manipulative tactics is crucial for cultivating a healthy sense of autonomy and independence.

What can victims of narcissistic financial abuse do to protect themselves?

If you suspect you’re a victim of narcissistic financial abuse, consider taking the following steps to protect yourself:

- Educate yourself about financial literacy

- Maintain separate bank accounts and credit lines

- Build a network of supportive friends and family

- Seek professional help, like a therapist or financial advisor

- Create an exit plan to leave the abusive relationship

Remember that overcoming financial abuse takes time and courage, but it’s essential for your well-being.

Why do narcissists often engage in financial manipulation?

Narcissists engage in financial manipulation to maintain control and power over their victims. They exploit their victims’ vulnerability to gain influence. By controlling finances, they ensure their victims depend on them and find it more challenging to escape the abusive situation. Realize that understanding the narcissist’s motives can help you protect yourself and stay vigilant.

When a narcissist gives or spends money, what are their hidden motives?

A need for power, control, and admiration drives narcissists. When they give or spend money, their hidden motives may include:

- Buying loyalty or affection from others

- Gaining leverage in relationships

- Undermining their victim’s self-esteem and independence

- Boosting their self-image and maintaining an illusion of success

Recognizing these hidden motives can help you be more cautious and discerning when dealing with a narcissist in financial matters.

From Personal Struggles to Your Guide: Jacob Maslow’s Journey

Hey there, I’m Jacob Maslow, and my path hasn’t been a straight line—it’s been more like a mountain trek, one that has had its fair share of rough weather. My journey through the storm of narcissistic financial abuse and the challenges of co-parenting with a narcissist is something I’ve lived, not just studied. My ex, embodying the extreme traits of narcissism, disrupted our family’s harmony, pursuing affairs and leading smear campaigns that would make any soap opera blush.

When the therapist finally got through to our kids, ending the alienation, my ex pulled the plug on cooperation. It was a hit to my world. Now, I’m fighting an ongoing court battle for my two minor kids, trying to navigate through the broken promises and blatant disregard for court orders.

As I’ve grappled with this, I’ve found solace and strength in daily long walks to clear my head and in managing my mental health with the help of Lexapro and therapy. I’ve recently joined BetterHelp, continuing my commitment to self-care and growth. My firsthand experiences have not only deepened my understanding of mental health but have also ignited a passion for helping others navigate these turbulent waters.

I write not just as a therapy veteran but as someone who’s been in the trenches of mental health battles. On my legal site, I extend a helping hand to those wrestling with non-compliant spouses and the agony of parental alienation. I share my knowledge and personal insights because knowledge is not just power—it’s healing.

The bond I shared with my kids was my anchor, and losing that connection has tested me in ways I never imagined. But here I am, turning my pain into purpose, ensuring that no one has to walk this path alone. Remember, we’re in this together, and with the right support and resources, anyone can reclaim their peace and pave the way to a healthier, happier life. Let’s take that walk toward recovery, one step at a time.

- How to Win Sleep Apnea VA Claim: Insider Tips and Steps - February 14, 2024

- Emotional Support Goat: A Guide to Healing Companions - February 14, 2024

- Alteril Sleep Aid: Your Trusted Solution for A Peaceful Night’s Sleep - February 14, 2024

This site contains affiliate links to products. We will receive a commission for purchases made through these links.

Understanding Narcissist Financial Abuse

Understanding Narcissist Financial Abuse Traits of a Financially Abusive Narcissist

Traits of a Financially Abusive Narcissist Common Tactics of Financial Abuse

Common Tactics of Financial Abuse Surviving and Overcoming Financial Abuse

Surviving and Overcoming Financial Abuse Preventing Financial Abuse

Preventing Financial Abuse The Red Flags in Your Wallet: When to Seek Therapy

The Red Flags in Your Wallet: When to Seek Therapy Setting Goals for Growth: Establishing a New Financial Future

Setting Goals for Growth: Establishing a New Financial Future