As a BetterHelp affiliate, we receive compensation from BetterHelp if you purchase products or services through the links provided

If you ask anyone who’s currently or has ever been in debt, they’ll tell you what a devastating toll it has on your mental health. It’s now such a common problem that mental health professionals have given it a name: debt stress syndrome. To elaborate, here’s a rundown of how lowering your debt simultaneously lowers your stress level.

Improving Sleep Quality

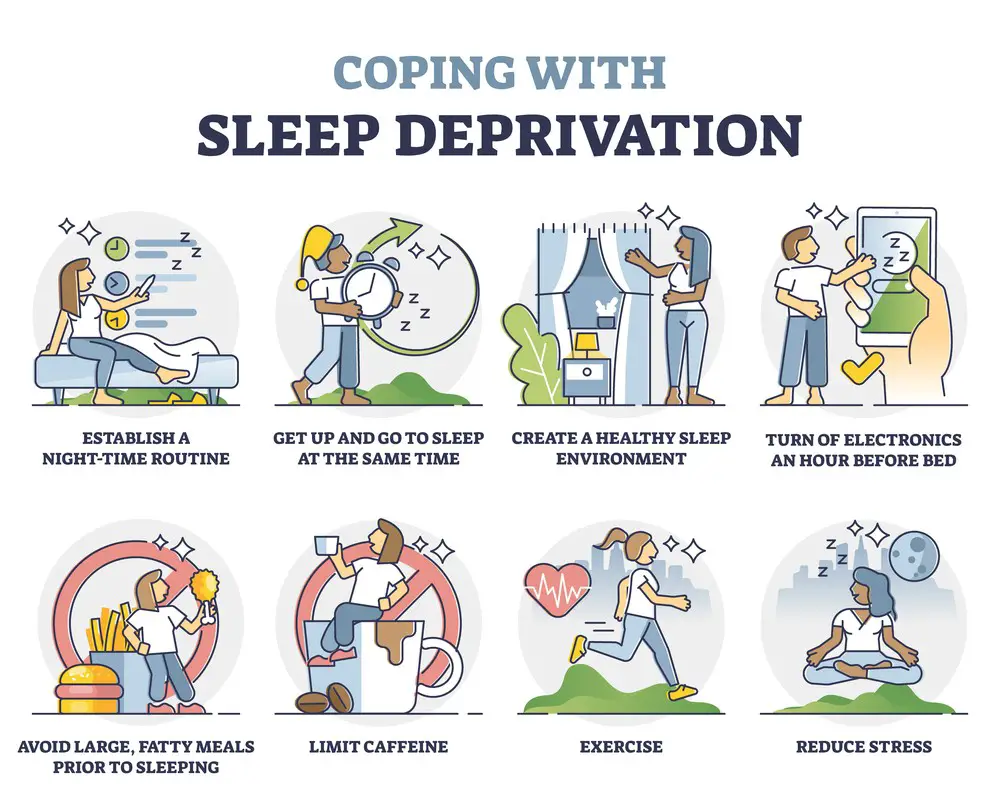

One of the most debilitating aspects of debt stress syndrome is that it often causes sleep disruptions. People lie awake at night wondering how they’ll pay bills or when they’ll stop being able to tread water financially. That leads to inadequate sleep and sets up a vicious stress cycle.

Research demonstrates that a lack of sleep leads to subsequent emotional overreactions to stressors. That exacerbates the already-existing debt stress, leading to even less restful sleep. Before you know it, being in debt might guarantee you never have a peaceful night of sleep for weeks on end.

Reducing debt can break the cycle of stress-induced sleep disruptions. Then, as your sleep habits improve, you can better handle the remaining stress that comes with being in debt.

Increasing Leisure Activities

Another cause of debt-related stress is that it forces people into a position where they give up things they enjoy. For example, you may take on a second job and stop making time for hobbies and leisure activities. That may sound innocuous, but it can lead to ever-increasing stress levels. Overwork is a known cause of multiple physical and psychological maladies. Reducing your debt can prevent the need to overwork, restore your work/life balance, and eliminate a significant stress source.

Restoring Financial Flexibility

Being in debt has significant financial implications that can make daily life much more challenging. For example, people with high debt loads will pay more and more to service that debt. That often happens even after taking steps to prevent the debt from increasing. It occurs because high debt causes a decrease in credit score, which triggers higher interest rates from creditors. Then, it becomes even more challenging to maneuver financially.

Before long, debtors often find meeting their daily financial needs challenging. They face impossible decisions, such as buying food or making a minimum debt payment. Or, they may turn to predatory lenders to get by. Having such choices forced upon you over and over leads to significant mental strain.

Reducing your debt meaningfully can restore some of your financial flexibility. It can help you keep monthly debt service within your means and free up money to cover necessary living expenses. That alone can create significant stress relief.

Manageable Balances Equal Lower Stress

The main takeaway is that there’s a clear link between high debt and stress. Its effects can be far-reaching and self-reinforcing. Therefore, anything an individual can do to reduce their debt should have a corresponding impact on their stress levels. The stress reduction associated with lowering debt can put one in the right mental state to finish the job by eliminating their debt. And that’s an outcome whose stress-reduction benefits should be more than evident.

- 7 Ideas to Help You Relax and Unwind on a Family Vacation - April 27, 2025

- How Having Cybersecurity Protection Helps You Relax - April 25, 2025

- 8 Reasons Why Spending Time Outside Calms You Down - April 25, 2025

This site contains affiliate links to products. We will receive a commission for purchases made through these links.